In the construction industry, managing finances effectively is as crucial as executing a project on time.

A pervasive challenge that construction managers face is delayed or defaulted payments from clients.

Such delays can severely impact the cash flow, disrupt project timelines, and even affect the overall financial stability of a business.

This issue not only strains the relationship between contractors and clients but also puts a significant strain on the resources of the construction firms, potentially leading to layoffs or reduced operational capacity.

Understanding the Root Causes

To effectively tackle the issue, it’s essential to understand its causes. Payment delays in construction can stem from various sources:

- Client Financial Issues: Clients may face their own financial constraints, affecting their ability to make timely payments. Economic downturns, poor budgeting, or overextension on other projects can lead to such scenarios.

- Disputes Over Work: Disagreements regarding the quality or scope of work can lead to withheld payments. Sometimes, this arises from mismatched expectations or a lack of clear communication about project deliverables.

- Bureaucratic Delays: Especially in large projects involving government contracts or big corporations, bureaucratic processes can delay payments. Layers of approvals and complex funding structures often contribute to these delays.

- Contractual Misunderstandings: Ambiguities or misunderstandings in the contract can also lead to payment disputes. Vague terms or poorly defined project scopes can result in disagreements that impede payment.

The Ripple Effect on Construction Businesses

The consequences of delayed payments are significant:

- Cash Flow Disruptions: Construction companies often rely on steady cash flow to pay subcontractors and for materials. Delays can lead to a chain reaction where subcontractors and suppliers are also unpaid, causing tension and distrust.

- Project Delays: Insufficient funds can lead to halted or slowed project progress. This not only affects the current project but can also tarnish the company’s reputation and hinder future business opportunities.

- Credit Challenges: Frequent payment delays can impact the company’s creditworthiness. This can lead to higher interest rates on loans or difficulty in securing future financing, further exacerbating financial strain.

Legal Framework and Protections

Understanding legal protections is crucial. Construction contracts should clearly define payment terms, and companies should be aware of lien laws that protect their right to payment.

In many jurisdictions, construction businesses have the right to place a lien on a property if they aren’t paid.

Additionally, being familiar with the prompt payment provisions in contracts and local regulations can empower companies to enforce their rights more effectively.

It’s also beneficial to consult with legal professionals who specialize in construction law to ensure that contracts are ironclad and protective.

Proactive Strategies for Minimizing Risks

- Vetting Clients: Conduct financial background checks on new clients. Assessing a client’s payment history and financial stability can provide crucial insights into potential risks.

- Clear Contractual Terms: Ensure that contracts clearly outline payment schedules, scopes of work, and dispute resolution mechanisms. This clarity can prevent many disputes and misunderstandings that lead to payment delays.

- Milestone-Based Payments: Structure payments to coincide with the completion of project milestones. This approach not only ensures a regular cash flow but also aligns payment with progress, making it easier for clients to evaluate and approve.

- Effective Communication: Maintain open lines of communication with clients regarding project progress and any issues that may impact payments. Regular updates and meetings can help in preempting disputes and fostering a collaborative approach to problem-solving.

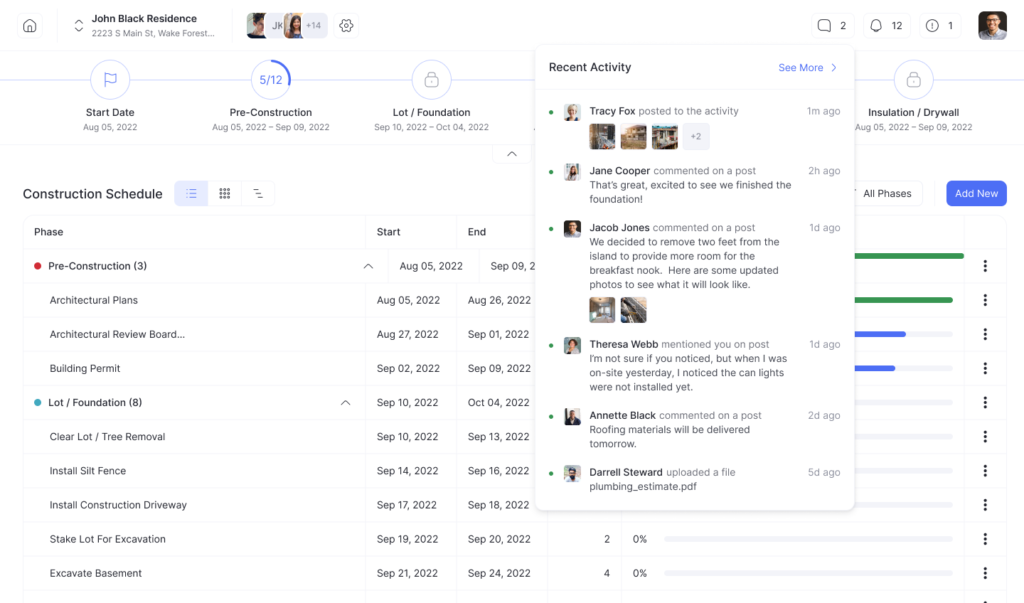

Builderpad offers efficient communication and scheduling tools that foster relationships with clients and help avoid misunderstanding:

Best Practices for Payment Collection

- Efficient Invoicing System: Implement a system that promptly and accurately issues invoices. Automated invoicing systems can reduce errors and ensure timely billing.

- Timely Reminders: Send reminders as payment deadlines approach. These reminders can be automated and personalized, maintaining a professional yet assertive approach to payment collection.

- Negotiation Skills: Be prepared to negotiate with clients facing genuine financial difficulties. Understanding the client’s situation and offering flexible payment options can sometimes salvage a valuable business relationship and ensure eventual payment.

Preparing for the Worst-Case Scenario

If a client defaults entirely, it’s essential to know the next steps:

- Legal Recourse: Understand the legal options available, including filing a lien or taking legal action. Consulting with a legal expert can provide guidance on the most effective and efficient course of action.

- Collection Agencies: In some cases, partnering with a collection agency might be necessary. Choosing a reputable agency that understands the construction industry can increase the chances of recovering owed funds while maintaining professionalism.

Managing payment delays in construction requires a proactive approach, focusing on prevention, clear communication, and legal preparedness.

By implementing these strategies, construction managers can better safeguard their businesses against the financial disruptions caused by delayed payments. It’s about creating a culture of transparency and accountability, both within the company and in its dealings with clients.

Key takeaways

- Understanding the root causes of payment delays, such as client financial issues, disputes over work quality, bureaucratic delays, and contractual misunderstandings, is essential for tackling this pervasive issue.

- Payment delays can severely impact construction businesses through cash flow disruptions, project delays, strained credit, and legal complications. Being aware of lien laws and prompt payment provisions is important.

- Mitigating risks via comprehensive client vetting, clear contracts, milestone-based invoicing, and open communication channels with clients is crucial. Real-world case studies also provide helpful strategic insights.

- When payments are delayed, having robust systems for timely invoicing, payment reminders, and flexible client negotiation is vital, as is preparing for worst-case legal scenarios and collections assistance.

- Ultimately, construction firms need to take a proactive, preventative, and legally-empowered approach to managing client payments, focused on accountability, communication, and transparency. This creates a culture that minimizes the impacts of delayed payments on construction projects and businesses.